- Home

- Meet the Team

- Log In

- Contact

- Careers

- Search

- Search Results

- Branches & ATMs

- Rates

- Log In

- About MCU

- Join MCU

- Personal Banking

- Lending

- Credit Cards

- Insurance

- Member Resources

- MCU Financials

- Forms and Disclosures

- Privacy Policy

- Automated Telephone Banking

- Order New Checks

- Security & Fraud Alerts

- Privacy Notice

- Scholarship Search

- Schedule an Appointment

Find a Mortgage That Works for You.

Make your dream home a reality with an MCU mortgage—enjoy flexible loan terms, low-interest rates, and guided support from our team of expert Lending Sales Specialists.

Competitive Rates

Keep more money in your pocket while you work toward home ownership. MCU members enjoy low interest rates with all of our loan options, regardless of your preferred term length.

Easy Online Application & Management

You can apply for a Conventional Mortgage using MCU’s easy online application. Making payments online is easy too with our suite of flexible, automatic payment tools.

Top-Tier Support

Our expert team of Lending Sales Specialists is here to help ensure that you have the resources you need to make informed financial decisions, every step of the way.

We’re Ready to Help You Get Past Any Homebuying Hurdles.

Whether you’re just starting browsing for real estate in your area or have already picked out your dream home, MCU is ready to help you bring your goals to life.

Our team of Lending Sales Specialists is excited to help you find the right lending option for your unique needs, and ready to answer any questions that pop up along the way.

1744.jpg?width=697&height=664&name=ready-to-help-you-get-past-homebuying-hurdles_image-isolated-(1).jpg)

Saving for a 20% Down Payment? There’s Another Option.

Say "goodbye" to hefty down payments! Private Mortgage Insurance (PMI) reduces your initial required down payment below the typical 20%, making it easier than ever to say "hello" to homeownership. MCU members may be eligible for an exclusive offer—we cover the monthly PMI costs for you!

Competitive Fixed-Rate Mortgage Options

No matter the length of your investment, we offer competitive interest rates to support your goals and turn your dream house into a home.

Looking for a Different Type of Mortgage?

Finding the right mortgage can be challenging. That’s why we offer our members a variety of mortgage options—all with member-friendly terms, competitive rates, and top-notch support.

Jumbo Mortgages

Purchasing a luxury home or higher-priced property? A Jumbo Mortgage may give qualified borrowers a higher lending limit—up to $1 million.

High-Balance Mortgages

In the market for a home in a high-cost neighborhood? With a High-Balance Mortgage, the borrowing limit may be higher based on area market values.

Adjustable Rate Mortgage

Want the best of both worlds? Our Adjustable Rate Mortgages combines the benefits of fixed and adjustable rates into one great loan option.

Get Expert Support, When You Need It.

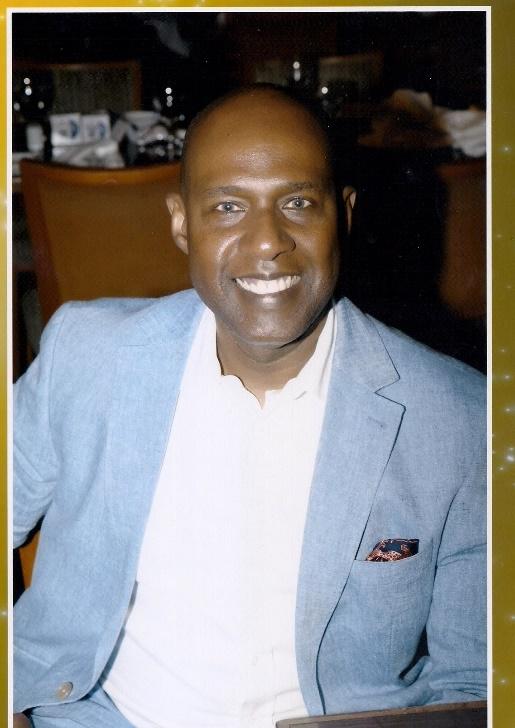

Warren Irons

Sean Remy

Gabrielle Naughton

Explore Additional MCU Lending Options.

We work hard to ensure that our community heroes get the financial support they deserve. Whether you're buying a home, a vehicle, or something else, MCU is here to help you along the way.

Personal Loans

Need to pay for an unexpected expense, a special event, or just need some extra cash to consolidate some high-interest bills? An MCU Personal Loan is a hassle-free way to access the funds you need and take control of your finances.

Auto Loans & Services

Get access to reliable products that help you buy, refinance, or insure your car. Explore our affordable loan and service options so you can focus on what really matters: grocery runs, daycare pickups, or a new commute.

No Matter Where You Are in Life, We’re Right There with You.

At MCU, we believe that a credit union should be a lifelong source of financial education and support—from planning for college to saving for retirement and everything in between.

That’s why we have specialized recommendations for products and services designed to help you meet your goals (both short-term and down the road), based on your changing needs and priorities.

Make the Most of Your MCU Membership.

Membership in our community is about more than just banking. As an MCU member, you can access valuable information and resources to help you plan and reach your financial goals.

.jpg)

All about Private Mortgage Insurance (PMI)

What to Consider Financially As A First-Time Homebuyer

Mortgages 101: Getting Started on The Path to Homeownership

FAQs

Get Answers to Our Most Frequently Asked Questions.

Is there a cap on how much I can borrow with a conventional loan?

What type of documentation do I need for a conventional loan?

When you’re ready to apply for a conventional loan, it’s a good idea to have these documents ready to go:

- Tax returns

- Pay stubs, W-2s or other proof of income

- Bank statements and other assets

- Credit history report

- Gift letters

- Photo ID

- Renting history

- Debt history

Can I only buy certain types of homes with a conventional loan?

What is the primary benefit of conventional loans?

How much of the down payment do I need for a conventional loan?

Disclosure:

*APR = Annual Percentage Rate.

PAYMENT EXAMPLES DO NOT REFLECT AMOUNTS DUE FOR TAXES, HOMEOWNER'S INSURANCE AND PMI INSURANCE (PMI INSURANCE WILL BE REQUIRED IF YOU ARE BORROWING MORE THAN 80% OF THE APPRAISED VALUE OF THE PROPERTY). THEREFORE, YOUR ACTUAL PAYMENT OBLIGATIONS WILL BE HIGHER.

Above APRs are based on loan amounts of $280,000. Above rates are applicable to loans secured by a 1-2 Family home which is the principal residence of the borrower(s). Different rates may apply for loans secured by Co-ops, Second/Vacation homes and 3-4 Family homes. Rates may be higher based on applicant’s creditworthiness. Rates and terms are subject to change without notice. Certain restrictions may apply. For more details, see our Rates page.

Previous Menu

Previous Menu