- Home

- Meet the Team

- Log In

- Contact

- Careers

- Search

- Search Results

- Branches & ATMs

- Rates

- Log In

- About MCU

- Join MCU

- Personal Banking

- Lending

- Credit Cards

- Insurance

- Member Resources

- MCU Financials

- Forms and Disclosures

- Privacy Policy

- Automated Telephone Banking

- Order New Checks

- Security & Fraud Alerts

- Privacy Notice

- Scholarship Search

- Schedule an Appointment

Never Settle For Less.

A high-balance mortgage lets you go above and beyond typical loan limitations, and increased lending limits means you can secure a home with a high market value. Get the most out of your mortgage with a super-conforming loan from MCU.

Higher Borrowing Limits

Looking for a home in a higher-cost housing market? A high-balance home loan features an increased lending limit based on local property values.

High-Cost Area Financing

Get access to the schools, neighborhoods, and recreational living of high-cost counties as defined by the Federal Housing Finance Agency (FHFA).

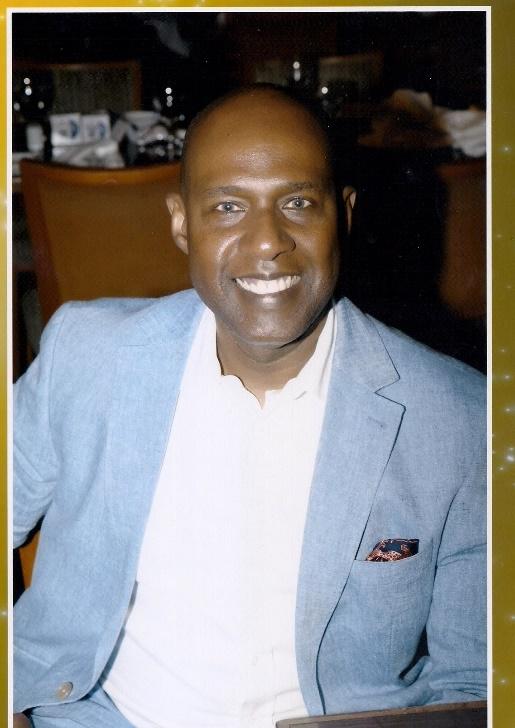

Top-Tier Support

As an MCU member, you’re never alone. When you bank with us, you get access to a team of experts to help you achieve your goals.

We’re Ready to Help You Get Past Any Homebuying Hurdles.

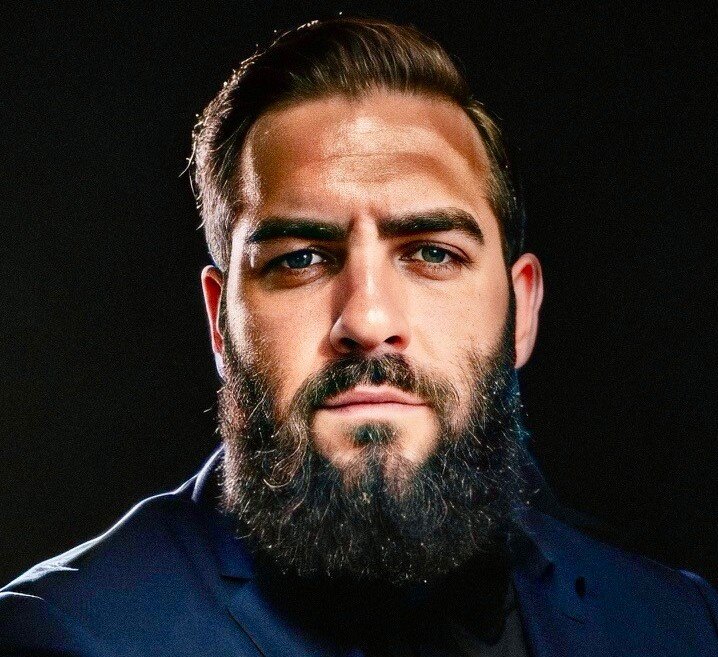

Whether you’re just starting browsing for real estate in your area or have already picked out your dream home, MCU is ready to help you bring your goals to life.

Our team of Lending Sales Specialists is excited to help you find the right lending option for your unique needs, and ready to answer any questions that pop up along the way.

Take Advantage of a Fixed-Rate High-Balance Mortgage.

Experience peace of mind knowing your rate is locked in for the full duration of your loan.

Looking for a Different Type of Mortgage?

Finding the right mortgage can be challenging. That’s why we offer our members a variety of mortgage options—all with member-friendly terms, competitive rates, and top-notch support.

Get Expert Support, When You Need It.

Connect with one of our Lending Sales Specialists to receive personalized support with all of your lending needs—just another perk of being a member of the MCU community.

Explore Additional MCU Lending Options.

We work hard to ensure that our community heroes get the financial support they deserve. Whether you're buying a home, a vehicle, or something else, MCU is here to help you along the way.

No Matter Where You Are in Life, We’re Right There with You.

At MCU, we believe that a credit union should be a lifelong source of financial education and support—from planning for college to saving for retirement and everything in between.

That’s why we have specialized recommendations for products and services designed to help you meet your goals (both short-term and down the road), based on your changing needs and priorities.

Make the Most of Your MCU Membership.

Membership in our community is about more than just banking. As an MCU member, you can access valuable information and resources to help you plan and reach your financial goals.

.jpg)

All about Private Mortgage Insurance (PMI)

What to Consider Financially As A First-Time Homebuyer

Mortgages 101: Getting Started on The Path to Homeownership

FAQs

Get Answers to Our Frequently Asked Questions.

Is there someone that can help me with questions I have?

How do I know if I qualify for a High-Balance Mortgage?

What is the limit of a High-Balance Mortgage?

Do I need a 30-month term to have a High-Balance Mortgage?

Disclosure:

*APR = Annual Percentage Rate. Above APRs are based on loan amounts of $580,000. Above rates are applicable to loans secured by a 1-2 Family home which is the principal residence of the borrower(s). Different rates may apply for loans secured by Co-ops, Second/Vacation homes and 3-4 Family homes. Rates may be higher based on applicant’s creditworthiness. Rates and terms are subject to change without notice. Certain restrictions may apply. For more details, see our Rates page.

Previous Menu

Previous Menu